INSURANCE BROKING

Our client base includes a varied range of individuals and businesses involved in virtually every field, including construction, the energy industry, food service, manufacturing & distribution, offshore contracting, professional services, property management, retail operators and telecommunications. PRFC's bespoke solutions include cost-effective mechanisms to manage:

BUSINESS RISKS

A significant interruption in your operations can have prove devastating to your long-term prospects. Our Business Continuity Planning advisory services can help you to approach these challenges in an objective, methodical and cost effective manner, helping to ensure the resilience of your business regardless of what life throws at you.

Commercial Insurance solutions can play a key part in effective Risk Management, and PRFC can guide you on focused solutions in regards to Business Interruption, Political Risks, Workmen's Compensation cover, Group Health plans, Cyber Risk Analysis and Control, and Products Recall cover, amongst others.

CONSTRUCTION PROJECTS

PRFC has significant experience in managing the risks inherent in construction projects of every size, analysing the exposures & negotiating the appropriate operational controls, Contractors All Risks cover, including providing suitable levels of protection from third-party liability exposures.

FINANCIAL RISKS

The costs and cash-flow effects associated with financial losses can be devastating, and in addition to assisting in risk mitigation measures, we can offer cover for Money All Risks, Cash in Transit, and Fidelity Guarantee cover. In addition we also offer Performance, Advance Payment and Performance Bonds, as well as industry-specific insurances such as Bankers Blanket Bond and Jeweller's Block cover.

LIABILITY EXPOSURES

As society becomes more and more litigious, adequate safety nets are critical - implemeting strong procedural protocols, taking advantage of contractual transfers and deploying the appropriate Public and Products Liability cover is essential for all businesses, firstly to reduce claim frequency and severity, but also to ensure that in the event you are accused of negligence, the defense costs and costs awarded can be covered by a robust safety net.

The more particular liability exposures professionals are exposed to in fulfilling their duties can also be managed, via covers such as Professional Indemnity, Pollution exposures, Medical and Dental Malpractice, Errors & Omissions, and Directors' & Officers liability cover.

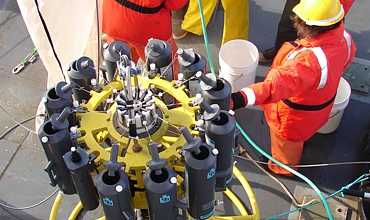

MARINE & AVIATION INSURANCE

The very scale and complex nature of Marine & Aviation risks requires a particularly careful approach. Apart from substantial Marine Hull, Machinery & Equipment values, onerous multi-party contracts often exist with very high Protection & Indemnity requirments, and usually with a parallel need for rapid adjustments in cover to suit the unforgiving pace of the industry.

PRFC is highly experienced in this area, providing support in contract negotiations, and ensuring that the arrangements of engaged third parties do not conflict with those of our clients. We also offer specialty insurance products designed for Undersea Analytical Equipment and for the burgeoning Unmanned Aerial Vehicle industry.

MOTOR RISKS

Our team has all of the resources and experience necessary to manage private & commercial Motor Insurance programmes, including Fleet Management support, seeing the process through for the fair and timely settlement of claims.

We also arrange Motor Contingency and other specialty covers, and can adapt existing solutions to meet the higher limits of liability mandated by Principals for service providers whose vehicles are engaged in the energy industry.

PERSONAL INSURANCES

We can assist personal clients with a range of solutions, including individual & group Homeowners' Comprehensive cover, Jewellery Insurance, Personal Accident cover, International and Group Health plans, comprehensive and affordable Global Travel Insurance, for individuals and sporting bodies, and Legal Expenses cover.

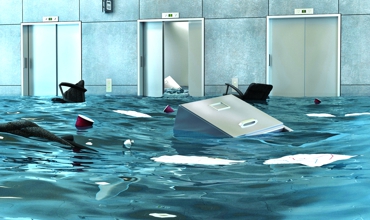

PROPERTY INSURANCE

The myriad risk exposures that commercial property is subjected to can be cost-effectively managed: A cohesive Risk Management strategy along with supporting financial transfers such as Property All RIsks policies address the vast majority of loss exposures and additional extensions such as Terrorism & Sabotage are readily available to suit the needs and risk appetite of our clients.

SPECIALTY RISKS

PRFC has a long history of developing and providing solutions for specialty risk exposures, including but not limited to Contingency cover, Special Event insurance, Agricultural Risks, Medical Facility cover, Fine Art & Specie risks, and consulting on new product development.